Visualization Tear Sheets

TearSheet is the visualization class for the pairs analysis process based on different modules implemented in the ArbitrageLab package. It creates a locally ran Flask server, bringing an interactive approach to the data visualization with Plotly’s Dash.

Note

Running run_server() will produce the warning

“Warning: This is a development server. Do not use app.run_server in production, use a production WSGI server like gunicorn instead.”

However, this is okay and the Dash server will run without a problem.

Currently, two tear sheets are present in the module: Cointegration analysis and OU-model analysis available for the users.

Cointegration Tear Sheet

Note

All the methods used in the creation of this tear sheet are available in the arbitragelab.cointegration_approach module.

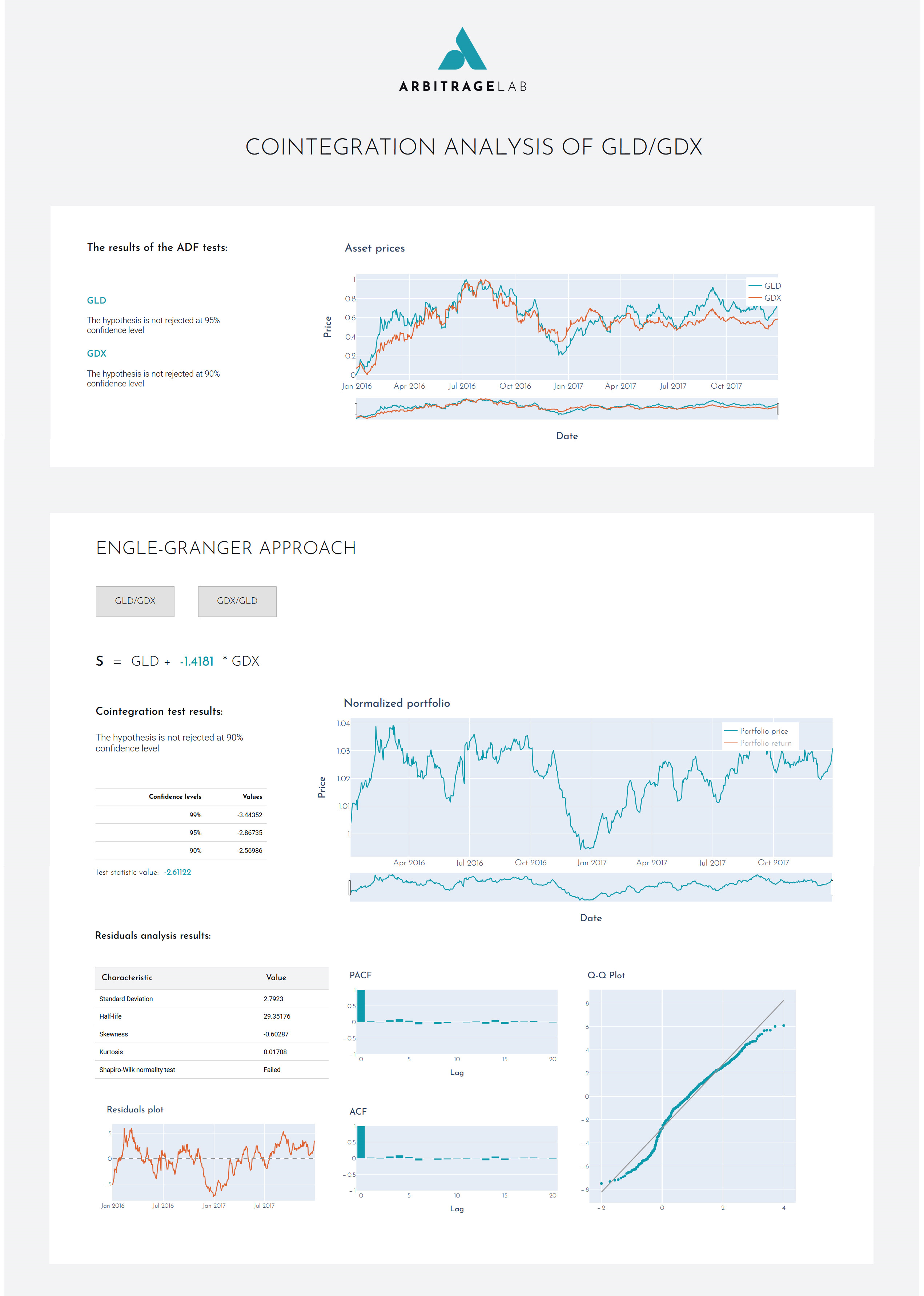

The first section contains the ADF test results for each of the assets from the provided pair separately and a plot of their normalized price series.

The second section is dedicated to the Engle-Granger cointegration test and further analysis. The results are provided for both possible combinations of the assets in the Engle-Granger-type portfolio and you can switch between them by clicking a respective button.

Provided data:

Portfolio coefficient

Cointegration test results

Normalized portfolio price/returns plot

Model residuals analysis

Statistical characteristics

Residuals plot

ACF and PACF plots

Q-Q plot

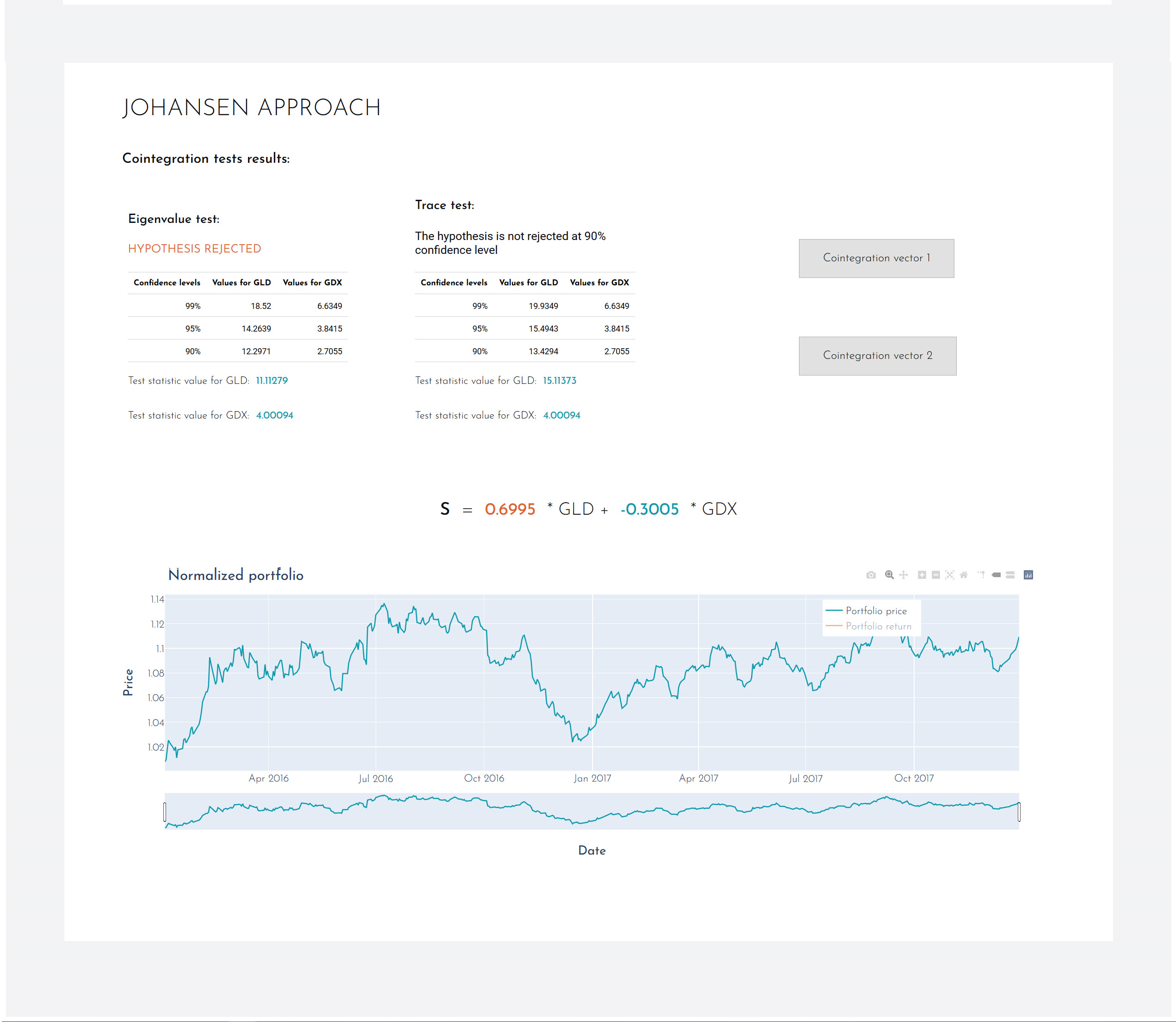

The third section is focused on the Johansen cointegration test and further portfolio analysis. The results are provided for both possible cointegration vectors of the assets in the Johansen-type portfolio, and you can switch between them by clicking a respective button.

Provided data:

Cointegrated portfolio coefficients

Cointegration test results for both eigen and trace cointegration tests

Normalized portfolio price/returns plot

Implementation

Code Example

# Import ArbitrageLab tools

from arbitragelab.tearsheet import TearSheet

# Initialize TearSheet class

tearsheet = TearSheet()

# Get server app

server = tearsheet.cointegration_tearsheet(data)

# Run server

server.run_server(port=8050)

OU Model Tear Sheet

Note

All the methods used in the creation of this tear sheet are availible in the arbitragelab.optimal_mean_reversion module.

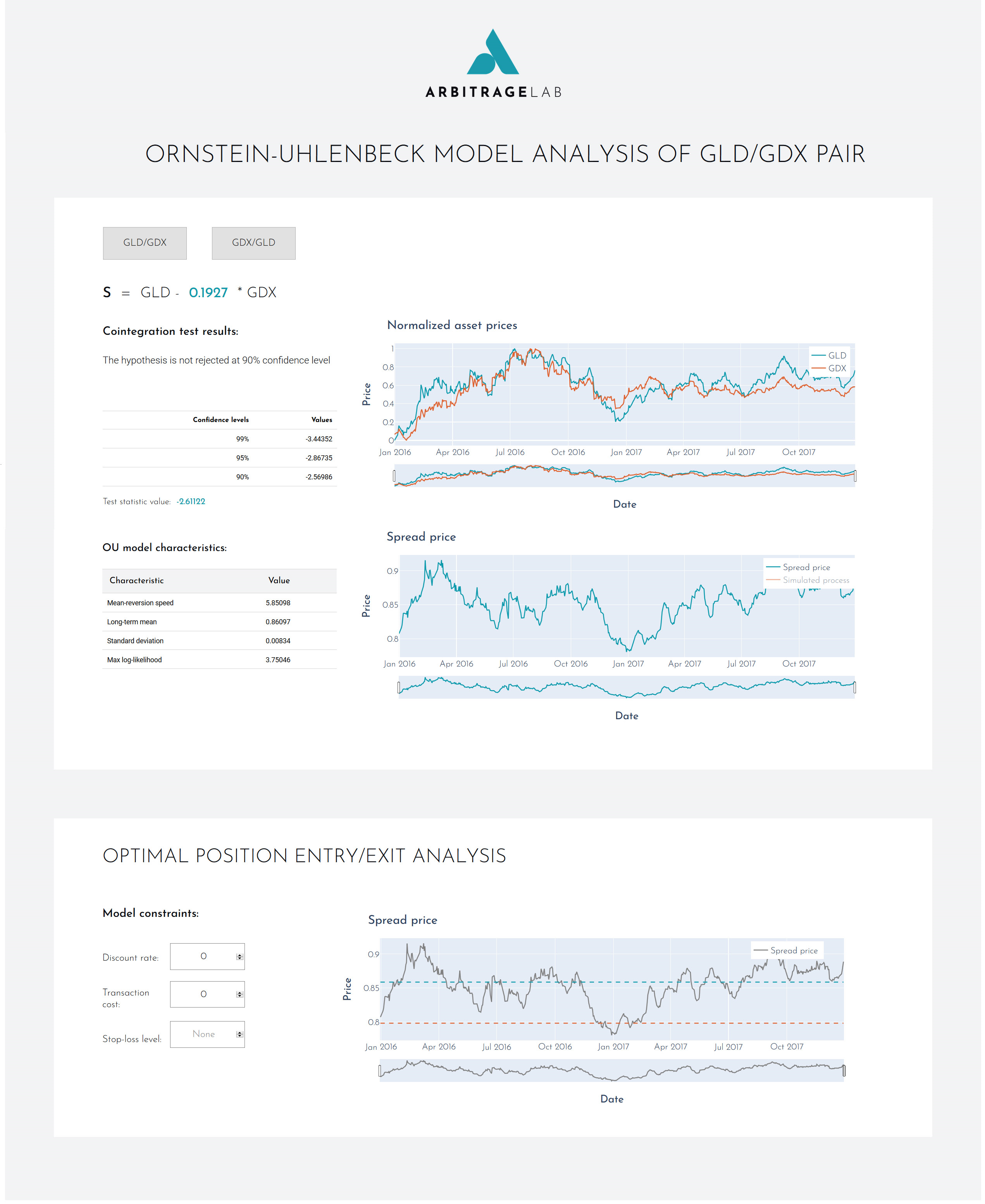

The first section contains the information regarding the cointegration of the provided assets and also parameters of the fitted OU model to created optimal spread. The results are provided for both possible combination of the assets in the Engle-Granger-type portfolio, and you can switch between them by clicking the respective button.

Provided data:

Optimal portfolio coefficient

Cointegration test results for the two assets

Normalized portfolio price/returns plot

Fitted OU process characteristics

Spread price

Simulated OU process with the same parameters

The second section serves as a testing ground for the optimal stopping and liquidation levels calculation. The user is invited to alter the values of the discount rate, transaction cost, or set a stop-loss level - if optimal solutions exist, all the changes will be reflected onto the optimal levels graph.

Note

The optimal levels graph may appear blank or unchanging after new parameters have been entered, since it takes time for the model to be retrained. However, they will load eventually.

Implementation

Code Example

# Import ArbitrageLab tools

from arbitragelab.tearsheet import TearSheet

# Initialize TearSheet class

tearsheet = TearSheet()

# Get server app

server = tearsheet.ou_tearsheet(data)

# Run server

server.run_server(port=8050)

Running Dash in Jupyter

You can easily run a Dash server within Jupyter Notebook. The Jupyter Dash library is used to provide this functionality.

When you initialize the server by using either cointegration_tearsheet or ou_tearsheet functions, you must add argument app_display='jupyter'.

Warning

Jupyter layout may not be optimal for all devices as it depends on the screen ratio, resolution and scaling.

To run the visualizations in Jupyter, replace:

# Import ArbitrageLab tools

from arbitragelab.tearsheet import TearSheet

# Initialize TearSheet class

tearsheet = TearSheet()

# Get server app

server = tearsheet.cointegration_tearsheet(data)

# Run server

server.run_server(port=8050)

With:

# Import ArbitrageLab tools

from arbitragelab.tearsheet import TearSheet

# Initialize TearSheet class

tearsheet = TearSheet()

# Get server app with extra argument 'jupyter'

server = tearsheet.cointegration_tearsheet(data, app_display='jupyter')

# Run server

server.run_server(mode='inline', port=8050)

Initialising the server with an additional argument 'jupyter', creates a JuptyerDash class instead of a Dash class.

Running mode='inline' will allow the interactive visualisations to display within a cell output of the Jupyter notebook.

For detailed explanations of the different modes, refer to

this article on Jupyter Dash.